EE 518 : Quiz 4

Problem 1

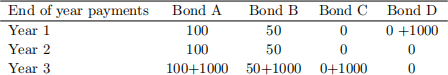

Consider the four bonds having annual payment as shown in Table below. The bonds are traded to produce a 15% yield.

1. Determine the price of each bond

2. Determine the convexity of each bond

3. Determine the duration of each bond (not the modiied duration)

4. Which bond is most sensitive to a change in yield?

Problem 2

A stock with current value S(0) = 100 has an expected growth rate of 12% and a volatility of that growth rate of σ = 20%. Find suitable parameters of a binomial lattice representing this stock with a basic elementary period of 3 months. Draw the lattice and enter the node values for 1 year. What are the probabilities of attaining the various inal nodes?

Problem 3

Consider the ARIMA model

(1 - q- 1 )S(k) = (1 - q- 1 ) (0.3S(k - 1) + 0.18S(k - 2),+ (1 - q- 1 )[e(k) + 2e(k - 2)]

1. Write the discrete time model equation.

2. Find the characteristic equation and compute its roots.

3. Simulate the model and obtain the irst 50 values of S(k) for S(1) = S(0) = 100 and e(k) 2 Ⅵ (0, 1).

4. Repeat part (3) when e(k) 2 Ⅵ (2, 1)