ASSIGNMENT 4

Math 174E

Release date: Friday, Feb 02, 2024

Exercises for Discussion Sections in Week 4

Exercise 4.1 (Hull, Question 4.34)

An interest rate is quoted as 5% per annum with semiannual compounding. What is the equiv-alent rate (p.a.) with (a) annual compounding, (b) monthly compounding, and (c) continuous compounding?

Exercise 4.2 (Hull, Question 4.32)

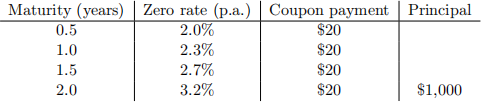

The table below gives Treasury zero rates and cash flows on a Treasury bond. Zero rates are continuously compounded.

(a) What is the bond’s theoretical price?

(b) What is the bond’s yield assuming it sells for its theoretical price?

Hint: You have to use a computer.

Exercise 4.3 (Hull, Question 4.20)

Suppose that 6-month, 12-month, 18-month, 24-month, and 30-month zero rates are, respec-tively, 4%, 4.2%, 4.4%, 4.6%, and 4.8% per annum, with continuous compounding. Compute the cash price of a bond with a face value of 100 that will mature in 30 months and pay a coupon of 4% per annum semiannually.

Exercise 4.4 (Hull, Question 4.24)

A 10-year 8% coupon bond currently sells for $90. A 10-year 4% coupon bond currently sells for $80. What is the 10-year zero rate?

Hint: Consider taking a long position in two of the 4% coupon bonds and a short position in one of the 8% coupon bonds (short selling financial securities will be covered in Lecture 13).

Exercise 4.5 (Hull, Question 4.28)

A 5-year bond with a yield of 7% (continuously compounded) pays an 8% coupon at the end of each year. The principal is $100.

(a) What is the bond’s price?

(b) What is the bond’s duration?

(c) Use the duration to calculate the effect on the bond’s price of a 0.2% decrease in its yield.

(d) Recalculate the bond’s price on the basis of a 6.8% per annum yield and verify that the result is in agreement with your answer to (c).

Exercise 4.6 (Hull, Question 4.29)

Tha cash prices of 6-month and 1-year Treasury bills are 94.0 and 89.0. A 1.5-year Treasury bond that will pay coupons of $4 every 6 months currently sells for $94.84. A 2-year Treasury bond that will pay coupons of $5 every 6 months currently sells for $97.12. Calculate the 6-month, 1-year, 1.5-year, and 2-year Treasury zero rates.

Comment: Treasury bills (T-bills) do not pay any coupons.

Exercise 4.7 (Hull, Question 4.23)

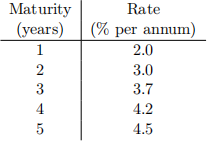

Suppose that risk-free zero interest rates with continuous compounding are as follows:

Calculate forward interest rates for the second, third, fourth, and fifth years.