FIN 3080 Investment Analysis and Portfolio Management

Spring 2024

Assignment I

Due: 23:59, March 10, 2024

Disciplines

• Late submission without a valid justification will give rise to a deduction of points.

• A complete submission shall include (i) one readable PDF file (1.5-spaced, 11pt, no longer than 5 pages) with your, if any, arguments, tables and figures, and (ii) one compressed package named with “YourID_YourName” containing one or many code files that generate the empirical results.

• You may discuss with your peers but plagiarism and fabrication are strictly prohibited.

• You may choose any programming languages to finish homework. Excel is not considered as a pro- gramming language.

Problems

1. Please access Stock Trading, Financial Statements and Financial Indicators databases on CSMAR and download the following data for all listed firms in the A-share market: (i) monthly stock prices, stock returns, market value of tradable shares from Jan. 2000 to Sep. 2023; (ii) quarterly total assets, total liabilities, earnings per share, ROA (return on asset), ROE (return on equity), R&D expenses from 2000Q1 to 2023Q3; (iii) establishment date and market type. Then complete the following two tasks based on the downloaded data.

(a) Manually derive monthly P/E ratios (stock price/earnings per share), monthly P/B ratios (stock price/book value per share), quarterly R&D expense/total asset ratios and quarterly firm ages (current date - establishment date).

(b) Provide summary statistics for monthly stock returns, P/E ratios, P/B ratios and quarterly ROA, ROE, R&D expense/total asset ratios, firm ages by market type (i.e., mainboard v.s. GEM board), compare summary statistics across two markets and discuss your findings. Note that summary statistics should at least include number of observations, mean, median, p25, p75, standard deviation.

2. Leveraging the data from problem 1, plot two time-series for median P/E ratio by market type. Then analyze the following: (i) Is it advisable to consider new investments in either market as of Sep. 2023? (ii) Given the P/E ratio figure, can you develop a trading strategy based on index ETF to make money?

3. The attached data file problem3_data.csv contains annual return on equity (ROE) and total revenue for firms listed in the mainboard from 2011 to 2020 (excluding financial companies). Please use this data to calculate annual median values for ROE and the total revenue growth rate for each year from 2011 to 2020. Then plot two time-series illustrating the percentages of companies that consistently maintain above-median ROE and total revenue growth rate over 2011 to 2020, respectively. Taking ROE for example, in 2011, you determine the percentage of firms with above-median ROE (which by definition is 50%); then in 2012, you calculate the percentage of firms with above-median ROE in both 2011 and 2012, and continue this analysis until 2020.

Hints

1. For each table, CSMAR details variable name, unit and description in “Field Description and Sample Data” .

2. The mainboard includes the SME board. The GEM board is consisted of ChiNext and STAR.

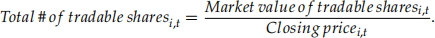

3. You may back out the total number of tradable shares for company i at time t with

Beware of the unit of market value of tradable shares on CSMAR.

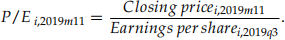

4. Note that financial statements are usually reported quarterly while stocks are traded every trading day. To construct monthly valuation measures, you may divide the closing price with the latest accounting indicator. For example, you may construct the P/E ratio for company i at 2019m11 (i.e., Nov. 2019) as follows:

5. You may exclude parent statements from financial statement and financial indicator data.

6. There may be multiple versions for certain earning capacity variables. You may choose one version and rationalize your choice in your solution.

7. In Problem 3, you may focus on a (sub-)sample of listed firms with complete records of ROE and total revenue from 2011 to 2020. The resulting two time-series should be decaying over time by construction.