MFIN7007ABCD: Economics for Financial Analysis

Feb. 27, 2024

Assignment 1 for Lecture on Consumption and Saving (Due on March 5, 2024)

1. Short-answer questions How would each of the following a§ect a consumer, ABCís cur- rent consumption and saving? Brieáy discuss the reasons. Here we assume that ABC is a forward-looking and optimizing consumer with no borrowing constraints.

(a) ABCís firm announces a reorganization plan, increasing ABCís expected future income dramatically.

(b) ABCís father, who had planned to leave her a large bequest, must spend all his wealth on medical bills after a prolonged illness.

(c) The real interest rate rises from its original level. ABC originally planned to have no assets for the future; that is, she planned to spend all her original assets and all her income when she was young, and planned to consume an amount equal to her future income when she was old.

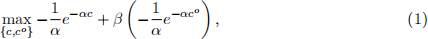

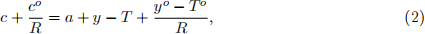

2. The Permanent Income Hypothesis Model. Consider an individual consumerís opti- mal consumption and saving problem: The consumer lives for two periods: young and old periods, and receives disposable income in these two periods. The consumer chooses optimal consumption to maximize his or her lifetime utility:

where e-ac and e-aco are exponential functions, subject to

where a > 0 measures the curvature of the utility function, β is the discount factor, R = 1+r is the gross interest rate, c and co are consumption in young and old periods, respectively, y - T and yo - To are disposable income received in young and old periods, respectively, and a is Önancial wealth. All of y , yo , a, T, and To are given.

(a) Assume that βR = 1. Find the optimal consumption and private saving when the consumer is young (c* and s* ) in terms of the model parameters and the exogenously given variables (e.g., a; y; yo ; T; To ).

(b) Assume that the Ricardian Equivalence principle does not hold for the consumer (e.g., the consumer is shortsighted). What are the effects of an increase in the lump -sum tax imposed on current income (i.e., an increase in T) on optimal current consumption and private saving (i.e., c* and s* ), holding y and government spending (G = T+To =R) constant? Please brieáy explain the intuition behind your results.