Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

FINAL EXAMINATION

MGM320H5S

Financial Reporting

Question 1: 80 marks

This exam consists of this exam question paper, plus supporting material for an analysis of Lowe's Companies, Inc. for the year ended January 28, 2022. Please note that the report refers to the year ended January 28, 2022 as “Fiscal 2021”.

The Excel file includes the following:

- 15-year historic Balance Sheet and Income Statement information

- 15-year historic Cash Flow Statement information

Based on the information given in the Excel file, you are required to conduct the following analyses:

1. Forecast major accounting items that are needed for the valuation analyses (30%)

2. Conduct a valuation analysis using the discounted cash flow model (25%)

3. Conduct a valuation analysis using the residual operating income model (25%)

For each analysis, please give the detailed steps, the accounting and financial data involved in the calculation, and the assumptions involved. The greatest number of marks will be awarded based on the assessment of the quality of the analysis of the various numbers that are calculated. The objective is for you to demonstrate that you understand the significance of the financial statements and can provide a supported analysis of these statements. Your analysis must also include a concluding paragraph giving your view on the valuation of the firm’s shares.

Question 2: 20 marks

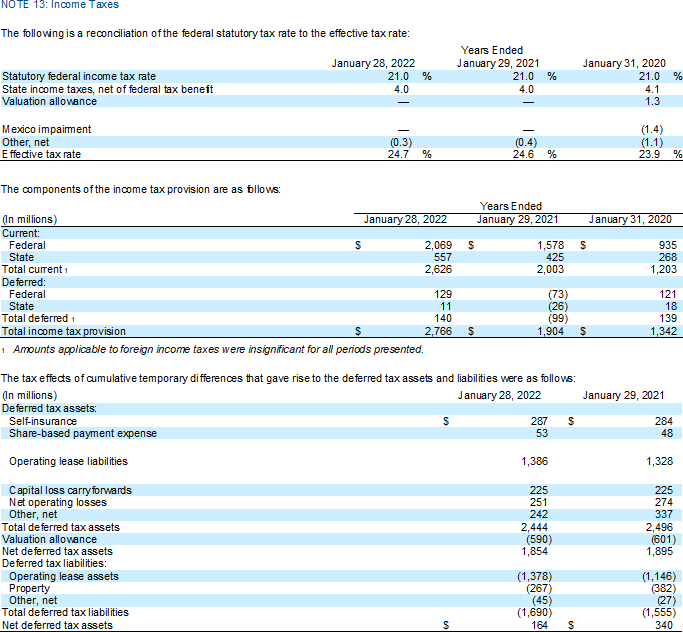

Use the following tax disclosure from Lowe’s and answer the following questions:

1. Provide a definition of “effective tax rate.” In Lowe’s tax disclosure, the effective tax rate for fiscal 2021 is 24.7%. How did Lowe’s obtain that tax rate? Using the information given in the tax disclosure and in Lowe’s income statement, show how the effective tax rate for fiscal 2021 is 24.7%. (8%)

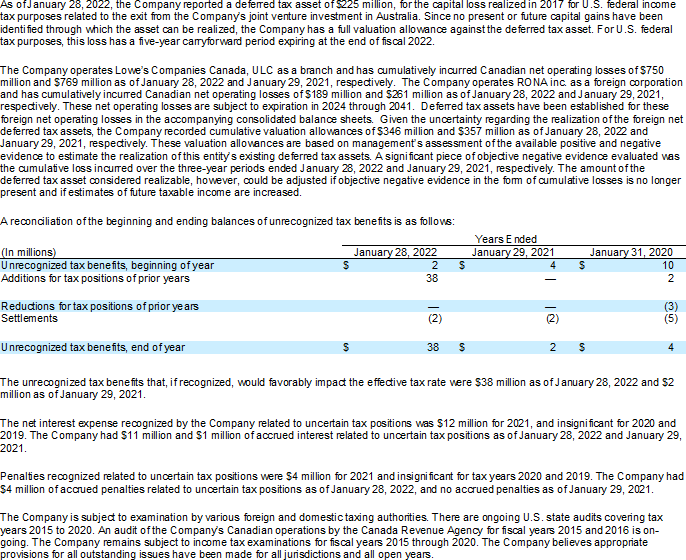

2. Lowe’s reported its net deferred tax assets at $164 million for fiscal 2021 which ended on January 28, 2022. What does the number mean? From the tax disclosure, what might contribute to the firm’s net deferred tax assets? (6%)

3. Lowe’s tax disclosure involves “valuation allowance.” In the context of Lowe’s tax disclosure, explain the nature of “valuation allowance.” (6%)