Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

EFIM20036: Limited Dependent Variables

Spring 2024

Relevant Readings: Wooldridge; “Introduction to Econometrics, A modern Approach” Main content: Chapter 17 - Section 1-4c.

Exercise 1 (Sample Final - Limited Dependent Variables). Consider modelling the following relationship between the likelihood that an individual business is audited by a tax authority and some regressors of interest, including the book value of your foreign assets, the businesses’ taxable income and the number of employees of the firm.

a) Comment on what are the potential limitations of using a linear probability model like:

Auditi = β0 + β1 ForeignAssetsi + β2TaxableIncome + β3 Employeesi + ui

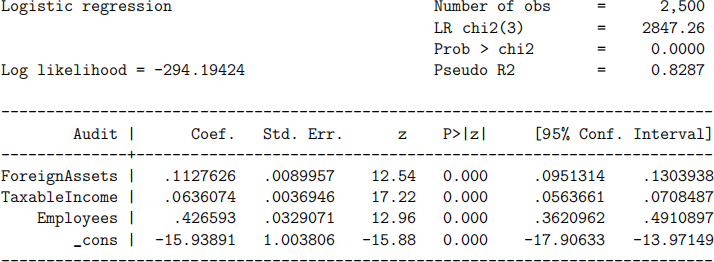

Suppose that instead, a logit regression is run:

logit Audit ForeignAssets TaxableIncome Employees

producing the output below:

Iteration 0: log likelihood = -1717.8225

Iteration 1: log likelihood = -516.13843

Iteration 2: log likelihood = -362.10857

Iteration 3: log likelihood = -295.59586

Iteration 4: log likelihood = -294.20231

Iteration 5: log likelihood = -294.19424

Iteration 6: log likelihood = -294.19424

In addition, the following post-regression output is produced.

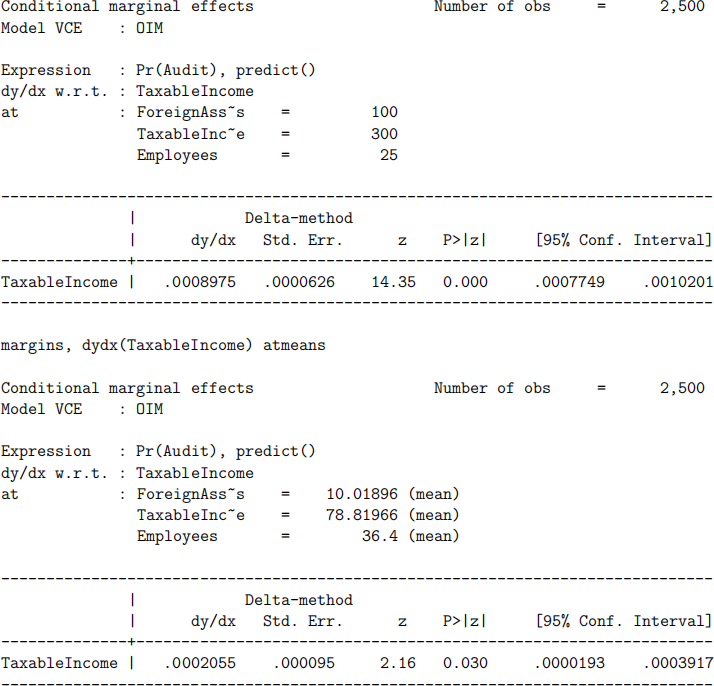

margins, dydx(TaxableIncome) at(ForeignAssets = 100 TaxableIncome=300 Employees=25)

as well as the following post-regression output:

b) Provide an estimate for the probability of being audited for a firm with 25 employees, a value of foreign assets equal to 50 thousand pounds and a taxable income of 30 thousand pounds.

c) Provide an estimator (that is, a formula) as well as an estimate (a number, for this sample) for the Marginal Effect at the Mean (for TaxableIncome) .

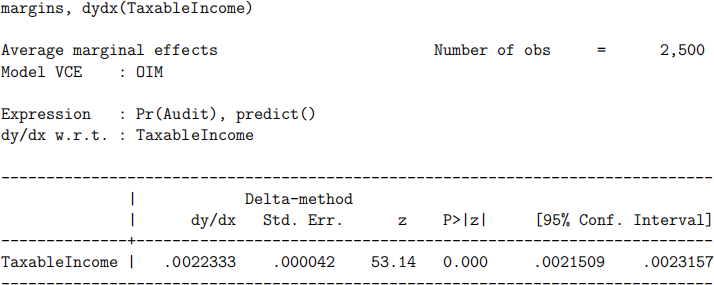

d) Provide an estimator (that is, a formula) as well as an estimate (a number, for this sample) for the Average Marginal Effect (for TaxableIncome) .

e) Are the Average Marginal Effect and the Marginal Effect at the Mean equal in general? Explain why or why not.