EC209-2024

MIDTERM ASSIGNMENT

INTRODUCTION TO BEHAVIOURAL ECONOMICS

1. Answer all parts (a) – (c) of this question (32 marks).

(a) Assume a Person A is offered the following game: If they want to participate in the game, they will need to pay £2. If they participate, they get to choose between Option A, which is a 40-60 lottery of winning £5 (with 40% chance) or winning £1 and Option B, which is a 40-60 lottery of winning £6 (with 40% chance) or winning £0.

(i) [2 marks] What is the expected value of Option A?

(ii) [2 marks] What is the expected value of Option B?

(iii) [2 marks] What is the expected value of participating in the game and choosing A?

(iv) [2 marks] What is the expected value of participating in the game and choosing B?

(v) [2 marks] How much would the game need to cost to make it a fair game when you choose Option A?

(vi) [2 marks] Person A does not want to participate in the game. What can be inferred about their risk preference and the shape of their utility function?

(b) Assume Persons B, C, D and E are offered the same game, but for a price of £3. Person B does not want to participate in the game. Person C is indifferent between participating and not participating. Person D decides to participate in the game and chooses Option A. Person E decides to participate in the game and chooses Option B. Which of the following statements are true for sure? For each correctly classified state-ment, you will receive +1 marks, for each incorrectly classified statement, you will re-ceive -1 marks.

(i) Person B is risk neutral.

(ii) Person B is risk loving.

(iii) Person C is risk neutral.

(iv) Person C is risk loving.

(v) Person D is risk neutral.

(vi) Person D is risk loving.

(vii) Person D is more risk loving than Person E.

(viii) Person B is more risk averse than Person A.

(ix) Person D is more risk averse than Person E.

(c) Consider an individual with the following utility function: U(x) = 2/1x2/1. This individual can play the following gamble: win £16 with probability 8/2 or win £4 with probability 8/6.

(i) [7 marks] Calculate the expected value and the expected utility of this lottery for this individual. What can you say about the risk attitude?

(ii) [4 marks] Calculate the certainty equivalent and the risk premium for this individ-ual.

2. Answer all parts (a) – (d) of this question (17 marks).

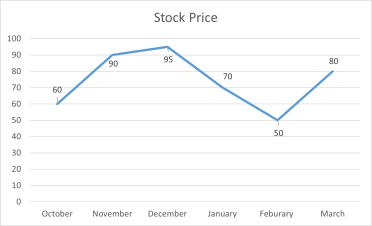

Person A, Person B and Person C own stock in the same company. All of them are loss averse and have the same value function: v(x) = x/2 for gains and v(x) = 2x for losses. The stock’s price is shown in the graph below

(a) [6 marks] Person A bought the stock in November and uses the purchase price as their reference point. If you ask them, how much would they say that they lost in terms of value when the price dropped from £95 to £70?

(b) [5 marks] Person B bought the stock in October and uses the peak price as their reference point. If you ask them, how much would they say that they lost in terms of value in January?

(c) [2 marks] In January, which month should Person B rather use as reference point in order to maximize their value?

(d) [4 marks] Person C bought the stock in March. They expect to derive a value of at least +5 in April as compared to their reference point of the purchase price. What is the minimum price that the stock will need to have in April to fulfill C’s expectations?

3. Answer all parts (a) – (c) of this question (29 marks).

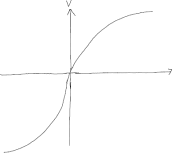

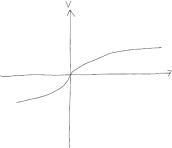

(a) [8 marks] Consider the below displayed value functions of two people, Person A (Fig-ure 1) and Person B (Figure 2). The scale of the axes is the same in both figures.

Figure 1: Person A

Figure 2: Person B

Compare the two persons regarding all of their preferences that you can speak to based on these figures.

(b) [6 marks] In prospect theory, imagine a person who is loss averse, but neither risk averse nor risk seeking. How would their value function look like? Describe in a way that would allow someone to draw the value function.

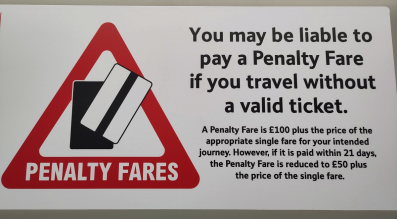

(c) In Greater Anglia trains, going for example from London to Colchester, you can find the following sign (see Figure 3).

Figure 3: Sign

(i) [10 marks] Explain why the company uses the pricing scheme for penality fares (described in the last two sentences) and why they explain it in this way. Be as specific as possible, referring to models and using terms that you have learned about in the module.

(ii) [5 marks] What could be a downside of explaining the scheme in that way? Briefly explain.

4. Answer all parts (a) – (c) of this question (22 marks).

(a) [6 marks] Think about the study by Ariely & Wertenbroch (2002). Classify the following statements.

For each correctly classified statement, you will receive +1 marks, for each incorrectly classified statement, you will receive -1 marks.

• The authors run an experiment with students to understand whether people adhere to deadlines.

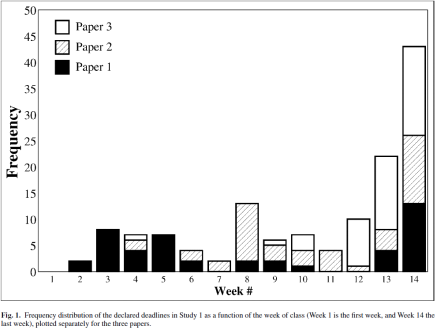

• Figure 4 (below) shows that the majority of students select their deadlines like a time-consistent, rational individual.

• Figure 4 suggests that some students are aware of their self-control problems.

• In the absence of sophistication, students cannot act on their procrastination.

• The study found that most students dislike setting costly deadlines.

• The study found that one large deadline at the end would be the best as it provides maximum flexibility.

Figure 4: Desired Deadlines in Study 1 (Ariely & Wertenbroch, 2002)

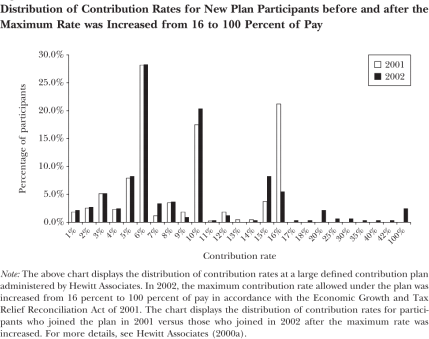

(b) [6 marks] Which of the following is true about the graph displayed in Figure 5? For each correctly classified statement, you will receive +1 marks, for each incorrectly classified statement, you will receive -1 marks.

Figure 5: Contribution Rates (Benartzi & Thaler, 2007)

• The graph shows that people are rational.

• One heuristic that can be seen in the graph is the conjunction effect.

• One heuristic that can be seen in the graph is the round number heuristic.

• One heuristic that can be seen in the graph is inertia.

• People in 2001 who chose 16% did not use heuristics.

• The graph shows that more than a quarter of participants chose the minimum neces-sary contribution of 6% to receive the employer match.EC209-2024

(c) [10 marks] Which of the following statements are true? For each correctly classified statement, you will receive +1 marks, for each incorrectly classified statement, you will receive -1 marks.

• The homo economicus is a useless model.

• Behavioral economics is better than standard economics.

• The Allais Paradox can be rationalized with expected utility theory.

• Individuals who are loss averse do not discount the future.

• Cumulative Prospect Theory only allows for the comparison of two options.

• With the βδ-model, we can describe patience.

• Biases are systematic decision errors.

• Anchoring at the default can explain low rates of organ donors in countries with the opt-in model.

• The conjunction effect can explain choices in the Linda problem.

• Sophistication is part of the βδ-model.

Technical Notes on Qualtrics

You should only complete the form once. While you fill it in, you can move back and forth through the form. The last page will ask you to take the photo/screenshot.

In theory, you can pause your entry. This requires several things (see below). I therefore strongly recommend to fill the form in one go, so nothing can go wrong.

Qualtrics automatically saves your responses when you move to the next page. This means that only responses from previous pages can be recovered when you leave the survey (e.g. by closing the window). Qualtrics places a cookie on your browser to allow ‘save and continue’. The next time you click the survey link, Qualtrics sees this cookie and knows to load your previous survey progress. Save and Continue only works if you return to the survey on the same computer and on the same web browser, and you have not cleared your browser cookies.