ECO380: Markets, Competition, and Strategy — Winter 2024

Problem Set #1

Due: Feb 14th, 2024, 11:59 PM

Please use Crowdmark to submit your answers as a PDF file. It is recommended that you use LATEXto write your solution. Read each question carefully and answer each part as best as you can. Partial credit will be given, so please show your work. Each problem contains several parts. Number each part of your answers.

For the empirical part, please submit the STATA output (tables, plots, coefficients, test statistics, etc.) as well as the STATA code that you have used to generate the output (use the verbatim environment to write code in LATEX).

Analytical Part (80 pts)

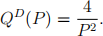

Q1. (15 pts) A monopolist faces demand

The marginal cost of producing the good is $0.25.

(a) (5 pts) Draw the inverse demand curve, the marginal revenue curve and the marginal cost curve. What price PM does the monopolist set? How many units QM of the good are sold at PM?

(b) (5 pts) Calculate consumer surplus, producer surplus and the deadweight loss.

Now suppose the monopolist can distinguish two consumer groups, group 1 and group 2. Inverse demand of group 1 and group 2 consumers is P1(D)(Q1 ) and P2(D)(Q2 ) respectively, where

(c) (5 pts) What prices P1(M) and P2(M) does the monopolist choose? Is the monopolist’s profit larger, smaller or equal compared to (a)?

Q2. (15 pts) A monopolist produces two goods, 1 and 2, at zero cost and sells them to a unit mass of consumers. A consumer values good 1 at v1 . A consumer’s valuation of good 2 is v2 = 2 −v1. Valuations are uniformly distributed on [0, 2] among consumers.

(a) (5 pts) Suppose the monopolist sells the two goods separately. What prices p1(m) and p2(m) does the monopolist set for goods 1 and 2 respectively to maximize profit?

(b) (5 pts) Suppose the monopolist sells the two products as a bundle. What price p12(m) does the monopolist set for the pure bundle to maximize profit? How do the monopolist’s profits in (a) and (b) compare?

(c) (5 pts) Now suppose that v2 = v1 . Find p12(m) . Does the monopolist profit from selling the two goods as a bundle? Why? Why not? Briefly explain.

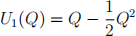

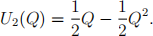

Q3. (20 points) There are two consumer types, 1 and 2. A type 1 consumer’sutility function is

and a type 2 consumer’s utility function is

The monopolist maximizes its revenue. It offers consumers to options.

Option 1 : Buy Q1 units of the good and pay P1 .

Option 2 : Buy Q2 units of the good and pay P2 .

(a) (5 pts) Suppose the monopolist observes consumer types and engages is third- degree price discrimination. Write down the participation constraint for each consumer type. What (Q1 , P1 ) and (Q2 , P2 ) does the monopolist choose?

(b) (5 pts) Suppose now the monopolist does not observe consumer types. Write down the incentive constraints that ensure that type 1 consumers choose (Q1 , P1 ) and type 2 consumers choose (Q2 , P2 ).

(c) (10 pts) Continue to assume that types are unobserved and let the share of type 1 consumers be 0 < s < 1/2. What (Q1 , P1 ) and (Q2 , P2 ) does the monopolist offer if it implements second-degree price discrimination?

Q4. (30 pts) Firms 1, 2 and 3 produce a homogeneous good. The inverse market demand function is PD (Q) = 12 − Q, where Q = q1 + q2 + q3 is the aggregate market output. All firms produce with zero marginal cost. The firms compete in quantities; there are no fixed cost.

(a) (5 pts) Suppose the firms choose their quantities at the same time. What is the best response function of firm 1? Are q1 and q2 strategic substitutes or strategic complements? Briefly explain.

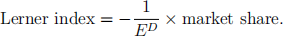

(b) (5 pts) Find the Nash equilibrium. What is the price elasticity of demand in Nash equilibrium? Verify that

(c) (8 pts) Suppose for the moment that firm 1 chooses its quantity first and, after observing q1 , firms 2 and 3 simultaneously choose their quantities. Find the subgame perfect Nash equilibrium of this game. Show that firm 1 enjoys a first- mover advantage. Is the market less or more concentrated than in (b)?

(d) (5 pts) Suppose that firm 2 and firm 3 merge. The merged firm and firm 1 choose their quantities simultaneously. Does the new, merged firm have a larger or smaller market share than firm 2 and firm 3 jointly had pre-merger? Is the profit of the merged firm larger or smaller than the sum of the profits of firm 2 and 3 pre-merger? What effect does the merger have on the market share and profit of firm 1?

(e) (7 pts) Assume firm 3 exits the market and firm 1 buys a 50% stake in firm 2. Set up the profit maximization problem of firm 1 and solve for the Nash equilibrium. Is the market share of firm 1 smaller or larger than 50%?

Empirical Part (20 pts)

In this section, we will use STATA to work with a dataset. We will first need to download dataset PS1.dta from Quercus, and load it into STATA. The dataset describes a fictional![]() retail chain that sells wine products across its retail stores over a sample period. Information includes product characteristics, prices, marginal costs, and sales (Note: see variable labels for further details).

retail chain that sells wine products across its retail stores over a sample period. Information includes product characteristics, prices, marginal costs, and sales (Note: see variable labels for further details).

Q1. (6 pts) Explore the dataset.

(a) (2 pts) Generate a table of descriptive statistics that details both retail prices and marginal costs in the dataset.

(b) (2 pts) Generate tables of descriptive statistics that summarize the retail price by wine product.

(c) (2 pts) Generate atable of descriptive statistics that summarizes the Lerner Index and includes its median value.

Q2. (6 pts) Manipulate the dataset.

(a) (2 pts) Create a variable named “average sales” that captures the average quantity![]() sold over products for each store at each period (Hint: use the command ”egen” and function “mean”).

sold over products for each store at each period (Hint: use the command ”egen” and function “mean”).

(b) (2 pts) Label this new variable as “Average Sales” .

(c) (2 pts) Create ascatter plot of average sales against time (Hint: use the command “scatter”).

Q3. (8 pts) Run a regression.

(a) (2 pts) Obtain the correlation coefficient between units sold and retail price.

(b) (2 pts) Run a linear regression of units sold against retail price, alcohol percentage, and sugar quantity.

(c) (2 pts) Create a scatter plot of units sold against the fitted value of the regression (Hint: after the regression, use the command “predict” with option “xb” to obtain fitted values).

(d) (2 pts) Test the hypothesis that the price coefficient is equal to 0 (Hint: after the regression, use the command “ttest”)