Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

ACCT5943-5246

Topic 2: Employee Benefits

Review Quiz

2024

Question 1

Venezia Ltd provides 10 days of sick leave to employees for each year of service on a non-vesting, accumulating basis. Unused sick leave may be carried forward for one financial year. Sick leave is taken first out of the current year’s entitlement and then out of any balance brought forward from the previous year.

On 30 June 2020, the company had 112 full-time employees on an average annual salary of $78468. At this date, 18 employees had taken their full entitlement to sick leave. The remaining employees had an average of 5 days accumulated leave (untaken).

Past experience indicates the following, which is expected to continue, for the remaining employees who had not taken full entitlement of sick leave:

A likelihood of 70% for these employees will take no more than 10 days sick leave in the following year.

A likelihood of 23% for these employees will take 12 days of sick leave in the following year.

A likelihood of 7% for these employees will take 13 days of sick leave in the following year

You should assume that there are 260 working days per year.

What is the sick leave provision balance for Venezia Ltd on 30 June 2020?

PLEASE ENTER YOUR ANSWER IN WHOLE NUMBERS WITH NO COMMAS OR DOLLAR SIGNS (EG $1,000,000 SHOULD BE SHOWN AS 1000000; -$1,000,000 SHOULD BE SHOWN AS -1000000).

Question 2

ABC Ltd has a policy that employees are entitled to a yearly 2 weeks sick leave. Sick leave policy is accumulating and non-vesting.

Sick leave unused in a financial year can only be carried forward for 1 financial year. For example, unused sick leave in the financial year ended 30 June 2020 must be used by 30 June 2021.

When taking sick leave, current year entitlements must be used first before any prior year carried forward balance is to be used.

In year 30 June 2020, an employee Mr. Monday Missing has taken 5 days of sick leave. There was no opening balance brought forward on 1 July 2019.

It is expected that the Mr. Monday Missing will take sick leave in next year under the follow scenario:

(Scenario W) 8 days sick leave next year,

(Scenario X) 10 days. A likely scenario when the competition is higher in the industry.

(Scenario Y) 15 days. A likely scenario when competition is high and the flu season is bad.

(Scenario Z) 18 days. A likely scenario when competition is high, flu season is bad, and the board is hiring a CFO candidate who is known for having an aggressive work style.

The CEO yearly salary is $129000

Select ALL THE CORRECT response to the sick leave EXPENSE scenario for Mr. Monday Missing in the year ended 30 June 2020 under the different scenario.

Do not simply select all choices as incorrect answers will attract negative marks.

a. Z: $4962

b. X: $2481

c. Z: $6450

d. W: $2481

e. Y: $4962

Question 3

Cooks River Ltd has completed the calculation of their overall employee long service leave entitlement. A total provision of $2200000 is required for the financial year ended 30 June 2021. The provision account has an opening credit balance of $2800000 on 1 July 2020. There has been no transaction posted to the provision account during the year. Cooks River Ltd employee headcount has reduced during the year due to resignations. The company should:

a. Dr. LSL Expense 600000 Cr. Provision 600000

b. Dr. LSL Expense 2200000 Cr. Provision 2200000

c. Dr. Provision 600000 Cr. Other Income 600000

d. Dr. Provision 2200000 Cr. Other Income 2200000

e. No journal is required as the existing provision of $2800000 is suffi cient to meet the requirement of the $2200000 provision needed

Question 4

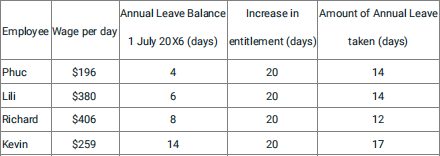

Paradise Ltd has four employees and each is entitled to 20 days of paid annual leave (hereafter, AL) per annum. All annual leave accumulated on 30 June 20X7 is expected to be paid by 30 June 20X8. A loading of 17.5% is paid when annual leave is taken. The following information is obtained from the payroll records for the year ended 30 June 20X7.

What is the value of the ending balance of the provision for annual leave on 30 June 20X7?

PLEASE ENTER YOUR ANSWER IN WHOLE NUMBERS WITH NO COMMAS OR DOLLAR SIGNS (EG $1,000,000 SHOULD BE SHOWN AS 1000000; -$1,000,000 SHOULD BE SHOWN AS -1000000).

Question 5

Eastwood Ltd employs 9 staff. Each staff member is entitled to 20 days annual leave per annum. Leave loading of 18% is paid when the leave is taken.

On 31 December 2022 Penny Day left the company and was paid out her untaken leave entitlements. Penny had 12 days leave owing at 1 July 2022 and took 19 days leave between 1 July and 31 December 2022. Her salary at the time of her departure was $94000.

There are 260 work days in a year. On 1 July each year all employees receive a 3% wage rise.

The paid out amount of untaken leave entitlements will take the leave loading into account and also be determined by the salary at the current period.

The gross entitlement owing to Penny Day for her payout on 31 December 2022 was:

a. 5546

b. 1085

c. 11519

d. 1280

e. 1318

Question 6

Which of the following types of sick leave have the same accounting treatment and effect as annual leave?

Select one:

a. Non-accumulating

b. Accumulating

c. Non-accumulating and non-vesting

d. Accumulating and vesting

e. Accumulating and non-vesting

Question 7

Fang Fang current salary is $ 79000 per annum. It is expected that her salary will increase at the forecast infl ation rate of 5% per annum.

Fang Fang joined Matilda Ltd on 1 July 2014. All employees of the Matilda Ltd are entitled to a 13 weeks long service leave when they complete 10 years of service.

The discount rate for high quality corporate bonds with 4 years and 6 years to maturity is 6% and 8% respectively, and the likelihood of Fang Fang staying with the company until 30 June 2024 is 37%.

Calculate the provision required for long service leave for Fang Fang at 30 June 2018?

a. 6171

b. 2612

c. 6671

d. 2098

e. 2468

Question 8

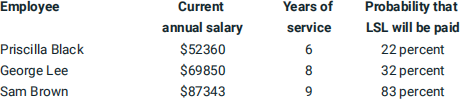

XYZ Ltd has three employees who are entitled to long service leave (LSL). The LSL can be taken after 15 years of service, at which time the employee is entitled to 10 weeks’ leave. Information about the employees at 30 June 2020 is set out below:

Other information collected:

The infl ation rate for the foreseeable future is 3 percent.

The future salaries of the employees are expected to keep pace with infl ation but not increase as a result of promotion.

The opening balance of the LSL provision is $7001.

What is the ending balance of long service leave provision for the year ended 30 June 2020?

PLEASE ENTER YOUR ANSWER IN WHOLE NUMBERS WITH NO COMMAS OR DOLLAR SIGNS (EG $1,000,000 SHOULD BE SHOWN AS 1000000; -$1,000,000 SHOULD BE SHOWN AS -1000000).

Question 9

Sky Ltd started operating on 1 July 2017 with 13 employees. 8 years later, all of those employees were still with the company. On 1 July 2019, the company hired 13 more people but by 30 June 2025, only 8 of those employed at the beginning of that year were still employed by Sky Ltd.

All employees are entitled to 13 weeks long-service leave after a conditional period of 10 years of employment with the company.

Below is the information available as of 30 June 2025:

The aggregated annual salaries of all employees hired on 1 July 2017 is now $700,000.

The aggregated annual salaries of all current employees hired on 1 July 2019 is now $600,000.

Salaries are expected to increase indefi nitely at 2% per annum.

The probability that employees hired on 1 July 2017 will continue to be employed for the duration of the conditional period is 42%.

The probability that employees hired on 1 July 2019 will continue to be employed for the duration of the conditional period is 32%.

The opening balance of the provision for long-service leave was $6,000.

The interest rates on high-quality corporate bonds are as follows:

1 July 2024 30 June 2025

Maturing in 2 years 4% 5%

Maturing in 3 years 7% 7%

Maturing in 4 years 8% 8%

Maturing in 5 years 9% 9%

What is the ending balance of the long-service leave provision as at 30 June 2025?

Select one:

a. 72402

b. 61488

c. 78402

d. 28914

e. 84402