ASSIGNMENT 3

Math 174E– Winter 2024

Hubeyb Gurdogan

Release date: Thursday, Jan 25, 2024

Exercise 3.1 (Hull, Question 2.32)

Trader A enters into futures contracts to buy 1 million euros for 1.1 million US dollars in three months. Trader B enters in a forward contract to do the same thing. The exchange rate (dollars per euro) declines sharply during the first two months and then increases for the third month to close at 1.1300. Ignoring daily settlement, what is the total profit of each trader? When the impact of daily settlement (in the futures contract) is taken into account, which trader has done better?

Exercise 3.2 (Hull, Question 3.30)

It is now June. A company knows that it will sell 5,000 barrels of crude oil in September. It uses the October CME Group futures contract to hedge the price it will receive. Each contract is on 1,000 barrels of “light sweet crude”. What position should it take? What price risks is it still exposed to after taking the position?

Exercise 3.3 (Hull, Question 3.31)

Sixty futures contracts are used to hedge an exposure to the price of silver. Each futures contract is on 5,000 ounces of silver. At the time the hedge is closed out, the basis is s0.20 per ounce. What is the effect of the basis on the hedger’s financial position if (a) the trader is hedging the purchase of silver and (b) the trader is hedging the sale of silver?

Exercise 3.4 (Hull, Question 3.32)

A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is s28 and the standard deviation of the change in this price over the life of the hedge is estimated to be s0.43. The futures price of the related asset is s27 and the standard deviation of the change in this over the life of the hedge is s0.40. The coefficient of correlation between the spot price change and the futures price change is 0.95.

(a) What is the minimum variance hedge ratio?

(b) Should the hedger take a long or short futures position?

(c) What is the optimal number of futures contracts (when adjustments for daily settlement are not considered)?

Exercise 3.5 (Hull, Question 3.33)

A company wishes to hedge its exposure to a new fuel whose price changes have a 0.6 correlation with gasoline futures price changes. The company will lose s1 million for each 1 cent increase in the price per gallon of the new fuel over the next three months. The new fuel’s price changes have a standard deviation that is 50% greater than price changes in gasoline futures prices.

(a) If gasoline futures are used to hedge the exposure, what should the hedge ratio be?

(b) What is the company’s exposure measured in gallons of the new fuel? What position, measured in gallons, should the company take in gasoline futures?

(c) How many gasoline futures contracts should be traded? Each contract is on 42,000 gallons.

Exercise 3.6 (Hull 10th edition, Question 3.29)

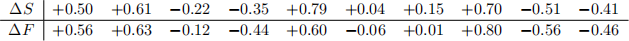

The following table provides historical data on n = 10 monthly changes in the spot price ∆S and the futures price ∆F for a certain commodity. Use the data to calculate a minimum variance hedge ratio.

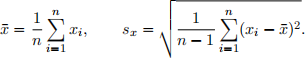

Hint: Recall that for a given sample x1 ,..., xn the sample mean ¯(x) and the sample standard deviation sx are computed via

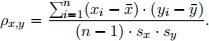

Moreover, given a series of n measurements of pairs (xi, yi), i = 1,...,n, the sample correlation coefficient is computed via