Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

Eco3420 Financial Economics

Problem Set 1

Due at 5pm on Tuesday, June 18, 2024

Problem 1 (Bonds)

The purpose of this problem is to help you practice the various concepts you learned in class with real data of bonds actually traded in the market, and familiarize you with commonly used data sources for bonds. In this problem, our goal is to estimate the 5-year cost of debt for Macy’s given different scenarios of data availability.

(a) Suppose the data of specific bonds issued by Macy’s are available.

1) Find the data of the most relevant bond from:

https://www.finra.org/finra-data/fixed-income/corp-and-agency

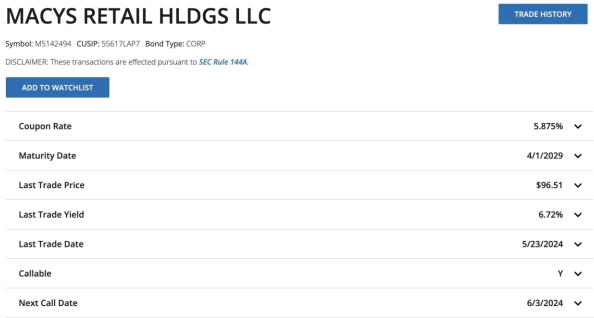

2) Use the following data as a reference for simplicity (Symbol: M5142494). For the rest of this question, suppose today’s date is 05/23/2024. Note that the price quoted is the clean price, the coupons are paid semi-annually and the face value is 100.

i) Write out the equation that defines the (annualized) yield-to-maturity of this bond and calculate it. (20 points)

ii) Based on the additional information on the historical default probabilities and recovery rates from the file BondData.xls provided with this assignment, estimate the 5-year cost of debt for Macy’s. ( 15 points)

iii) Suppose today is 5/23/2024, the date on which the data above was retrieved. Write out the equation that defines the duration of this bond and calculate it (use the convention of actual days / 365). Based on the duration that you calculate, how would the price of this bond change if its yield to maturity rises by 10 basis points (0.1%)? (20 points)

(b)

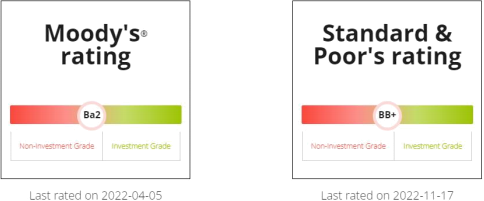

Now suppose you did not have the data on bond prices, but you knew that the firm’s rating is BBB (BB+) (shown as above). See the file market-transparency-report.pdf which is the most recent Market Transparency Report (April 2024). Estimate the cost of debt from the Yield table. Do you need to adjust for the default premium? If so, feel free to pull out a number from BondData.xls to make the adjustment. ( 10 points)

(c) Now suppose we didn’t have a bond rating for Macy’s. Find the most recent annual financial statements of Macy’s on Yahoo! Finance (https://finance.yahoo.com/quote/M/financials/). Calculate the interest coverage ratio and use it to estimate its bond rating based on the file rating.xls. Use the Yield table from part (b) (In Market Transparency Report) to estimate the cost of debt. ( 10 points)

Problem 2 (Bootstrapping)

The purpose of this problem is to help you practice bootstrapping. Suppose it is 2024/5/23 today. Use the bootstrapping algorithm to calculate all the relevant spot rates, and all the forward rates with borrowing period of one year. (25 points)

|

|

Bond A |

Bond B |

Bond C |

|

Settlement date |

2024/5/23 |

2024/5/23 |

2024/5/23 |

|

Maturity Date |

2025/5/23 |

2026/5/23 |

2027/5/23 |

|

Coupon Rate |

1.65% |

2.26% |

4.20% |

|

Face Value |

100 |

100 |

100 |

|

Price |

96.38 |

91.27 |

88.53 |

|

# of coupons per year |

1 |

1 |

1 |