Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

ECON0051 Economics of Regulation

Sample Exam Question No. 2

AY2023/24

Question on Topic ‘’Regulation vs Liberalization' (related to lec- tures Week 8 and 9 and PS4) Consider the liberalization of an industry in which an incumbent monopolist is currently subject to quantity regula- tion (as in the regulation model with demand uncertainty studied by Basso, Leonardo J., Nicol·s Figueroa, and Jorge V·squez (2017): ''Monopoly Regu- lation under Asymmetric Information: Prices versus Quantities'', The RAND Journal of Economics, Vol. 48, No. 3, pp. 557-578).

In particular, the monopoly firm has private information about consumer demand, as captured by a parameter θ ∈ [一10; 10]. The inverse demand function is P (q; θ) = 100 + θ 一 10/1q where θ is a demand shock parameter. The firm observes θ, which is its private information, while the regulator does not. However, the regulator has a prior belief about θ captured by a cumulative distribution function G (θ) with density g (θ) 三 G'' (θ) = 20/1. The firm's cost function is C (q) = 40q.

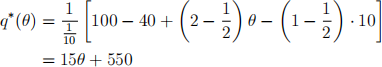

Under the regulator's expected welfare-maximizing incentive compatible quantity-regulation mechanism fq* (θ), T* (θ)gθ∈[0;1] (as derived in Tutorial 4 - you do not have to repeat this derivation here), in which the firm's profits receive a weight of a = 2/1) the firm is asked to produce an output quantity:

(a) [40 points] Use the information above to compute the numerical value of expected social welfare W under the optimal quantity-regulation mecha- nism fq* (θ), T* (θ)gθ∈[0;1] (you do not have to repeat the derivation of the expression for W from Tutorial 4). Then compute the welfare loss from asymmetric information by comparing this level of expected social welfare W to the one that would obtain in the first-best if the regulator observed the realization of θ just like the firm.

(b-1) [20 points] Now suppose the industry is liberalized without any further quantity regulation. A second firm with identical technology enters the market and competes in quantities with the original firm (Cournot com- petition). Both firms have the same cost function and both know the true realization of the demand shock and therefore face the inverse demand func- tion is P (Q) = 100 + θ - 10/1Q, where Q = q1 + q2 and qi , i = 1; 2, is the output quantity of firm i.

What is the industry equilibrium (price, output, firm profits, and social welfare) when the two companies compete in a single time-period by announc- ing simultaneously how much output they will sell? How does the expected social welfare under Cournot competition in the liberalized industry compare with the expected social welfare under quantity regulation of the monopoly firm in part (a)?

(b-2) [40 points] Finally, show that the possibility of collusion between the two Örms may further reduce the welfare from liberalization of the in- dustry. To this end, (for simplicity) assume θ = 0 so that inverse demand is P = 100 - 10/1Q and assume furthermore that the firms compete over an infinite horizon, discounting future profits at a rate of δ 2 (0; 1]. What dis- count rate would be sufficient for them to sustain a collusive outcome? You can assume that the collusive agreement takes the following form: firms set collusive prices as long as both firms have played the collusive strategy in the previous period. If either firm deviates, both firms resort to producing the competitive quantities (from part (i)) in all future periods.