Financial Risk Management (N1569)

Seminar Topic 4 Portfolio Level VaR

1. Calculate the 5% 10-day VaR for a portfolio with value $50m which is expected to return the discount rate with volatility 15%. Assume the discounted returns are normal and i.i.d.

Hint: The information given implies that discounted 10-day returns are NID(0, σ2 ) with

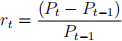

2. Download 5 years of daily data on a stock price from Yahoo Finance. Use the closing prices adjusted for dividends and stock splits to compute daily returns using the formula:

Then use these returns to compute α% h-day VaR for α% = 1% and 5% and for h = 1 and 10. Compare the results you obtain using the following VaR models:

(a) normal,

(b) historical, and

(c) normal Monte Carlo

3. A portfolio has daily returns, discounted to today, that are normal with expecta-tion 0 and a standard deviation of 2%. Find the 1% 1-day VaR. Then find the 1% 30-day VaR under the assumption that the daily excess returns

(a) are independent and

(b) follow a first order autoregressive process with autocorrelation 0.2.

(c) Repeat part (b) above but now with autocorrelation −0.2. Hence, comment on the effect of autocorrelation on VaR.