Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

MTH208: Coursework II

• Total marks for the coursework are 15.

• You just need to choose one of the following two questions to write a report.

• You may complete the work by using the provided solution sheet in word or tex.

• Please submit the completed solution via a submission link provided on the LMO.

• All the learning materials on the LMO can be referenced including lecture notes, Lab codes, extra reading materials. However, you must complete the coursework independently.

• Please convert your file into pdf before submission.

• Please name your submission in the form MTH017Final+ID+ZhangSan.pdf

• The coursework will be available on 9:00AM May 15th and deadline for submission is 9:00AM May 25th.

Question I

The absolute value function

f(x) = |x|, x ∈ [−1, 1]

is a continuous function, non-differentiable at x = 0. Approximating this function by polynomials played a significant role in the early development of approximation theory. In 1908, the Belgian mathematician de la Vall´ee-Poussin raised the question of finding the best approximation of the absolute value function on the interval [−1, 1]. This problem attracted the attention of several leading mathematicians of that period. Approximating the function |x| by means of polynomials or other functions was studied inten-sively starting with the beginning of the 20th century.

The objective of this project is to explore and compare various numerical methods (interpolation with various basis or fitting in discrete and continuous cases) for approximating the absolute value function. You may provide basic ideas of each numerical method, give the implementation details and then compare their performance in terms of accuracy, implementation details and computational efficiency (You don’t need to include the code in the report).

You are encouraged to refer to textbooks, academic papers, and online resources on numerical methods for function approximation to enrich your understanding and implementation of the numerical methods. By incorporating these additional details, you are expected to be prompted to delve deeper into the theoretical and practical aspects of numerical methods, enabling a more comprehensive exploration and comparison of the methods for approximating the absolute value function.

The assessment of the report will mainly consider two parts:

(i) the content of the report (10 marks) including research contribution, methodology and analysis, results and discussions;

(ii) format of the report (5 marks) including clear structure and format, clear figures and tables with captions, proper citations and references, precise presentation of results.

In the report, you may consider but not limited to the following chapters:

Introduction; Numerical methods & implementation details; Numerical Results; Conclusions; References etc.

You may refer to the format of the paper in box: https://box.xjtlu.edu.cn/f/6ace2cdbfb3e4643a9ba/

Question II

It has been found by Mandelbrot (1963) that financial asset returns are heavy tailed random variables. The expected shortfall (ES) is a very useful measure of the risk. For a continuous random variable X, its cumulated distribution function (cdf) is FX(x) := P(X ≤ x) and its probability density function (pdf) is fX(x) := F'X(x). The quantile function of X is

QX(p) = inf {x | FX(x) ≥ p} .

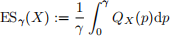

The expected shortfall of X at the level γ is defined as

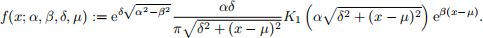

Assume X obeys the normal inverse Gaussian (NIG) distribution. NIG is defined as follows. First, we denote the modified Bessel function of the second kind with the index ν as Kν(x). Then, the NIG pdf is defined as

Your first task is to do a search on the definitions of Kν. There are definitions by differential equations and by integrals. Then, try to implement the function numerically on computer, and compare your result with the Matlab built-in function besselk. Your second task it to implement a function to compute numerically the expected shorfall of X.

The assessment of the report will mainly consider two parts:

(i) the content of the report (10 marks) including research contribution, methodology and analysis, results and discussions;

(ii) format of the report (5 marks) including clear structure and format, clear figures and tables with captions, proper citations and references, precise presentation of results.

Reference

B. B. Mandelbrot, The variation of certain speculative prices, Journal of Business, 36 (1963), 394-419.