FIN 448: Fixed Income Securities

Problem Set 5

Due 11:59pm on February 27, 2024

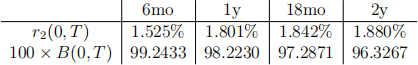

On December 29, 2017 the Treasury semi-annually compounded yield curve was

Ho-Lee Model

Consider a Ho-Lee model with r0 being the current (December 29, 2017) continuously compounded 6-month Treasury spot rate, semi-annual frequency, i.e. ∆ = 0.5, three periods (i = 0, 1, 2, 3), and volatility σ = 1.73%.

1. Construct the interest rate tree for the Ho-Lee model that would match the yield curve, i.e., it would match the prices of B(0, 1), B(0, 1.5), and B(0, 2) given above.

2. Consider a risk-free 1.5-year swap with semi-annual payments that exchanges the 6-month Treasury spot rate (semi-annually compounded) with the fixed rate of 2% .

(a) Convert the Ho-Lee interest rate tree you have constructed in Q1 from contin-uously compounded rates into semi-annually compounded rates. You will need these semi-annually compounded rates to compute the payments of the swap.

(b) Create an interest rate tree of the swap payments. To make this work, you will need to write the payments at the date when they are determined (rather then when they are paid).

(c) Using the payment tree you have constructed compute the model implied price of the swap. Recall that the swap payments will actually happen 1 period after they are determined, so you will need to discount them to get the present value.

(d) Compute the no-arbitrage (market) price of the swap. That is, compute the 1.5y swap rate and price the “old swap” with the 2% fixed rate.

(e) (Not for credit) Explain why the prices differ or coincide.

Callable Bonds in Ho-Lee Model

Suppose that on December 29, 2017 the treasury decides to issue a 2-year 1.5% fixed coupon callable bond with the first call date in 6 months. Use the Ho-Lee binomial tree with parameters

to answer the following questions:

1. What is the price of a non-callable 2-year 1.5% fixed coupon bond?

2. What is the price of the call option embedded into the 2-year 1.5% fixed coupon callable bond?

3. In which parts of the interest rate tree will the call provision be exercised?

4. What is the price of the callable bond?