ACC 201 Practice exam

Practice Exam

Part 1:

1. If assets increased 20,000 during a given period and liabilities decreased 4,000 during the same period, stockholders’ equity must have _____________ for the balance sheet to tally.

A. Increased by 24,000

B. Increased by 16,000

C. Decreased by 16,000

D. Decreased by 20,000

E. Decreased by 24,000

2. The following information is taken from the accounting records after the period of operation.

Retained earnings (op. bal.) 85 rent expense 25

Revenues 250 Cash 125

Accounts receivable 24 Equipment 110

Salary expense 18 Accrued utilities payable 65

Contributed capital 150 Accounts Payable 109

Machinery 100 Insurance expense 30

Net income is:

A. $207

B. $177

C. $112

D. $202

Use the following information to answer questions 3 and 4:

A company accepted 6,000 on June 30 for services to be performed evenly over the next twelve months.

The year end for this company is Dec 31.

3. The accounting entry that the company would pass on June 30 is:

A. Debit service revenue and credit accounts receivable for 6,000

B. Debit cash and credit revenue for 3,000

C. Debit cash and credit unearned revenue for 3,000

D. Debit cash and credit unearned revenue for 6,000

4. The accounting entry that the company would pass on Dec 31 is:

A. Debit unearned revenue and credit revenue for 6,000

B. Debit revenue and credit cash for 3,000

C. Debit unearned revenue and credit revenue for 3,000

D. Debit cash and credit revenue for 6,000

5. Net income equals

A. Assets – Liabilities

B. Assets + Liabilities

C. Revenues – Expenses

D. Assets – Liabilities – Owners’ equity

E. Revenues + expenses

6. Business Inc. pays payroll weekly of 8,000 on Fridays. The accountant is preparing the financial statements for the month of June. Assume that June 30 falls on a Monday. Which of the following is the required period end adjustment entry, assuming that a work week is from Monday to Friday?

A. Debit salary expense 1,600 and credit accrued salaries payable 1,600

B. Debit prepaid salary 1,600 and credit cash 1,600

C. Debit salary expense 6,400 and credit salaries payable 6,400

D. Debit salaries payable 6,400 and credit prepaid salary 6,400

E. None of the above

7. Which of the following is an account that is included in closing entries?

A. Rent expense

B. Prepaid rent

C. Accrued Rent payable

D. Furniture & Fixtures

8. In a certain year, accounts receivable had total debits of 4,500 and total credits of 5,300. If the beginning balance in Accounts receivable was 2,700, what was the ending balance?

A. 1,900

B. 3,500

C. 5,500

D. 7,100

E. 12,500

9.Which of the following reflects the impact of a transaction where $200,000 cash was invested by owners in the business?

A. Assets and retained earnings each increased $200,000.

B. Assets and revenues each increased $200,000.

C. Stockholders' equity and revenues each increased $200,000.

D. Stockholders' equity and assets each increased $200,000.

10. The group that primarily determines how accounting is practiced in the United States is:

F. FASB

G. NBA

H. NCAA

I. NFL

J. NHL

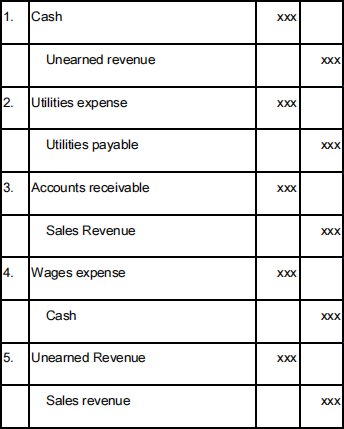

Problem 1:

Describe the transaction that created the following journal entries (amounts omitted).

Problem 1B:

Describe the debit and credit logic pertaining to revenues and expenses.

Question 2:

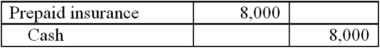

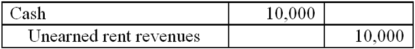

Below are four transactions that were completed during 2014 by Timber Lodge. The annual accounting period ends on December 31. Each transaction will require an adjusting entry at December 31, 2014. You are required to prepare the 2014 period end adjusting entries for Timber Lodge.

A. On July 1, 2014, Timber Lodge paid a two-year insurance premium for a policy on its facilities.

This transaction was recorded as follows:

B. On December 31, 2014, a tenant renting some storage space from Timber Lodge had not paid the rent of $750 for December.

C. On October 1, 2014, Timber Lodge collected $10,000 from a tenant for two years rent beginning October 1, 2014. The $10,000 collection was recorded as follows:

D. On February 1, 2014, timber lodge purchased office supplies during the year that cost $700 and placed the supplies in a storeroom for use as needed. The purchase was recorded as follows:

Office supplies inventory 700

Cash 700

At December 31, 2014, a count showed unused office supplies of $200 in the storeroom. There was no beginning inventory of supplies on hand.

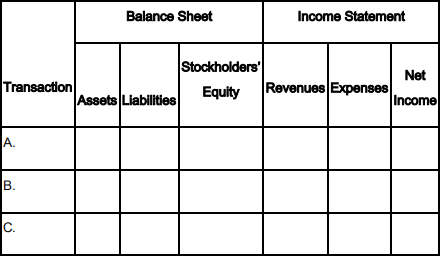

Problem 3:

For each of the following transactions, indicate the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Using the following format, indicate + for increase, - for decrease, and NE for no effect. Do not leave any blank spaces.

Transactions:

A. Wages of $5,800 have been earned, but not paid to employees at the end of the year.

B. Supplies in the amount of $2,000 were used during the year, which are currently recorded in the office supplies (inventory) account.

C. Audit fees incurred but not yet paid.