DIPLOMA IN BANKING & FINANCE

FIN5004 FINANCIAL TRADING

CONTINUOUS ASSESSMENT ONE

Individual Assignment

This Continual Assessment will contribute 30% towards your Term grade.

The paper consists of 4 questions and a chart on 4 pages.

Answer ALL questions and show ALL workings

Instructions

1. Include your Full Name and Student ID number on the cover page.

2. Type your assignment in an MS Word document using Times New Roman, font size 12. Save your file as , and submit it into the dropbox in Canvas. Please open the submitted file in Canvas to ensure correct file is submitted.

3. Students may use software e.g. PowerPoint, to sketch and paste it on the answer template.

4. Submission deadline in Canvas: 21 Jan 2023, 11:59 am.

5. In addition to the softcopy, students shall also submit a hardcopy to the lecturer on the immediate class after the submission deadline, i.e. 22 Jan 2024 for class L23.

6. Late submission (within 24 hrs) will be subjected to a 20% mark deduction.

7. Late submissions beyond 24 hrs will NOT be graded.

8. CA1 is an individual assignment and should be worked upon independently. Any form of plagiarism, collusion and/or use of artificial intelligence to complete the assignment will be penalised.

Important Notes:

Students caught for Plagiarism and/or Collusion will be subjected to heavy penalties.

Plagiarism & Collusion (extracted from the Student Handbook)

3.7.2 Plagiarism/Collusion

Plagiarism is theft of intellectual property. It is a form of lying, stealing and mistreating others. Students are reminded that plagiarism is a serious offence subject to the Institute’s disciplinary procedures.

Plagiarism can mean any one of the followings:

• direct copying of phrases and/or passages without a reference and/or quotation marks;

• paraphrasing another writer’s work in your written work without citing the reference;

• making a direct reference to an author you have not read although you may have read about him. The correct way is to reference the secondary source you have actually read rather than referencing the original which you have not read;

• copying the work of another student, in part or in whole;

• handing in an assignment that has already been submitted for assessment in the same or any other course.

Please note that it is also a disciplinary offence for students to allow their work to be plagiarised by another student.

A student found guilty of any of the above offences will render the student liable for disciplinary actions which may result in the voiding and adjustments to the continuous assessment grade, and may result in expulsion from the Institute.

Question 1 (10 marks)

Dow Theory

(a) With the help of TWO (2) clearly labelled diagrams (one showing an uptrend and one downtrend), describe the Dow Theory tenet - Volume must confirm the trend. Briefly explain this principle and include annotations on the diagrams.

[Do NOT attach lecture slides.] (4 marks)

(b) In another diagram, using arrows and annotations, describe the transition from an uptrend to a downtrend, clearly indicating the divergence between price and volume. Briefly explain this phenomenon and include annotations on the diagram.

[Do NOT attach lecture slides.] (2 marks)

(c) Give TWO (2) advantages of the volume indicator. (4 marks)

Question 2 (10 marks)

Chart Pattern

(a) With the help of a clearly labelled price and volume diagram, describe a Head & Shoulders pattern.Indicate the divergence between the price and volume diagram and the expected price objective when the pattern is fully formed. You may sketch the diagram by hand or on PowerPoint and then attach it to the answer template.

[Do NOT attach lecture slides.] (6 marks)

(b) Describe the formation of this pattern. (4 marks)

Question 3 (16 marks)

Refer to Chart 3 for this question. (Indicate all answers on the chart)

(a) Reference the beginning of the chart till June 2009. With the help of suitable line(s) and notation(s), indicate the trend on the chart. (2 marks)

(b) Reference to Box OL. With suitable lines and notations, indicate the market trend. (2 marks)

(c) Describe what a Key Reversal Day is. (4 marks)

(d) Reference the beginning of the chart till the end of 2009. Note TWO (2) candlesticks that best depict Key Reversal Days - upside and downside - by circling and marking KRD beside the candles. (4 marks)

(e) At the end of the chart, the price has broken out of its resistance. With the help of suitable lines and notations, mark out TWO (2) resistance levels (mark R1 & R2), and TWO (2) support levels (mark S1 & S2) on the chart. Include the respective prices. (4 marks)

Question 4 (14 marks)

Moving Averages

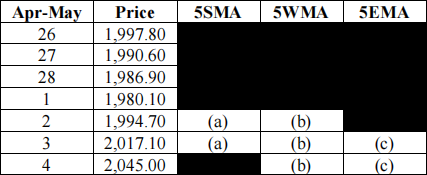

Calculate:

(a) 5-day Simple Moving Average (SMA) (2 marks)

(b) 5-day Weighted Moving Average (WMA) (6 marks)

(c) 5-day Exponential Moving Average (EMA) (4 marks)

Note: Give answers in the above table to TWO (2) decimal places. Show all workings and steps in the answer booklet.

(d) Give ONE (1) strength of a Moving Average line in a trending market, and give ONE (1) weakness of a Moving Average line in a sideways market. (2 marks)