Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

ECON 23950 Economic Policy Analysis

Practice Final #1

Part I. TRUE-FALSE Questions (33 points)

Please answer the following questions as TRUE or FALSE, and provide a justification using at most 3-4 sentences for each of the questions. The questions should be answered in the context of the theory and materials discussed in class or done in homework. A good answer often involves identifying a particular theoretical concept related to the question. No points will be given for an answer without a justification.

(5pts) 1. Government should smooth taxes over time under most circumstances.

(5pts) 2. Followings are rough data for the US economy: the GDP is $15T, the government spending and transfers total 33% of GDP, the debt-to-GDP ratio is 100%, the nominal interest rate on government debt is 2%, monetary base is $3T, and money multiplier is 0.9. Suppose that the entire spending, including interest expenses, is collected by seigniorage. Is the following statement true or false? The required rate of money growth is 175%.

(5pts) 3. Suppose that the Fed is thinking about reducing unemployment in the short run. According to the model by Lucas (1972), it will help the Fed if the public revises expectations slowly rather than quickly.

(5pts) 4. When the Fed prints more money, it necessarily increases money supply.

(5pts) 5. Sargent and Wallace (1981) in ”Some Unpleasant Monetarist Arithmetic” argue that, (1) in order to avoid catastrophe, a significant amount of seigniorage has to be raised to finance fiscal deficit and that (2) avoiding catastrophe is better because the economy would otherwise sufer from a higher inflation in the post catastrophe periods.

(8pts) 6. Money is neutral after all. (To get full credit, you need to briefly discuss the findings of Friedman and Schwartz (1963), King and Plosser (1982), and Romer and Romer (1989). You probably should write more than 3-4 sentences, but make your answers as concise as you can.)

Problems (67 points) Please solve the following two problems.

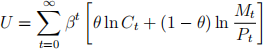

(30pts) 1. Suppose that the household maximizes the lifetime utility

where β = (1 + ρ)-1, subject to the following budget constraint in nominal terms

Pt Ct + Mt+1 + Bt+1 = PtYt + (1 + Rt )Bt + Mt - Xt

where Yt represents output that grows at the constant rate κ, and Xt represents lump- sum taxes/transfers. The monetary authority is holding the rate of growth of the money supply at µ. Note that this is an endowment economy where output is exogenously determined.

(a) Set up the households’ maximization problem and derive the FOCs. (5pts)

(b) Derive the MRS condition and Euler Equation. Interpret (Explain) them. (5pts)

(c) What is the elasticity of real money demand with respect to nominal interest rate? Explain what the number means. (5pts)

(d) Assuming that the real rate of interest is constant (which is true in this economy), solve for the equilibrium time paths of the nominal interest rate, the rate of inflation, and the log price level. (5pts)

(e) Discuss the efects of an increase in the rate of growth of the money supply on the equilibrium time paths of the real interest rate, the nominal interest rate, the rate of inflation, and the log price level. Use diagrams to summarize your answer. Is money neutral? (5pts)

(f) Discuss the efects of an increase in the rate of time preference ρ on the equilibrium time paths of the real interest rate, the nominal interest rate, the rate of inflation, and the log price level. Use diagrams to summarize your answer. (5pts)

(37pts) 2. In this question, we use a version of the Phillips curve that we have introduced in class to obtain another important result which compares the so-called discretionary and rule- based monetary policy options. Assume that the short-run behavior of the economy is captured by the following Phillips curve

u = u* + √ (pe - p)

where u is unemployment, u* > 0 is the natural rate of unemployment, pe is the logarithm of the expected price level, p is the logarithm of the actual price level, and √ > 0 is a parameter. We assume that the central bank directly controls p.

The central bank faces an inflation-unemployment tradeof as described by the above Phillips curve. It prefers a low unemployment rate but it also likes a stable price level. We capture this tradeof by specifying the following utility function for the central bank:

V = -u2 - φp2

where φ > 0 is a parameter. Since the function f (x) = -x2 has a maximum at zero, this utility function states that the central bank prefers u to be close to zero (low unemployment) and it also wants to stabilize p close to zero (this implies that the price level P should be held close to 1).

Let’s assume that the price level expectations, pe , is fixed for now. The central bank takes the public’s expectation’s as given.

(a) Set up the central bank’s problem and solve for the optimal price level and un- employment rate, denoted by ˆ(p) and ˆ(u), respectively as a function of pe and the parameters. (5pts)

(b) How does the optimal price level, ˆ(p), depend on φ? How does the optimal unemploy- ment rate,ˆ(u), depend on φ? In light of your answer, give an economic interpretation for the parameter φ . (5pts)

Now we assume that the public actually understands the intentions of the central bank, and knows that if it expected the price level pe then the central bank will implement theˆ(p) that we determined above.

(c) Assume that the public has rational expectations and full information, and hence correctly guesses the price level that will ultimately be implemented by the central bank. Determine the (Nash) equilibrium price level denoted by p-. Also show the equilibrium unemployment rate u associated with the above equilibrium price of p-. (5pts)

The policy that we have derived above is called discretionary policy the central bank observes the public’s expectations and implements the best possible policy. However, because consumers rationally expect that the central bank will act in this way, they will adjust their expectations accordingly.

An alternative solution in this situation is a rule-based policy option. The central bank can announce that it commits to implement p = 0, no matter what the public’s expectations are.

(d) If people believe the commitment of the central bank and the central bank follows through with the commitment, what is the price level˜(p) and unemployment rate˜(u)? (5pts)

(e) Is the central bank better of with the discretionary or with the rule-based policy option? Justify your answer mathematically. (5pts)

(f) Would the central bank be tempted to deviate from the rule-based policy and return to the discretionary option? Would you recommend the central bank to resist such temptations? Why (or why not)? (7pts)

(g) Discuss a commitment device(s) that the central bank can use to make its policy credible. (5pts)