Commerce 3FD3: Financial Modelling

ASSIGNMENT 2

Assume that you are the senior financial analyst at a small oil and gas drilling company, head-quartered in Edmonton, Alberta.

· Your manager has asked you sign a non-disclosure agreement in return for a stock option that will enable you to buy 12,000 shares of the company at $4.13/share, 3 years from now.

· The expectation is that you will remain with the company for the next 3 years; the stock option will accrue evenly over the 3 years, and vest immediately if you are terminated early.

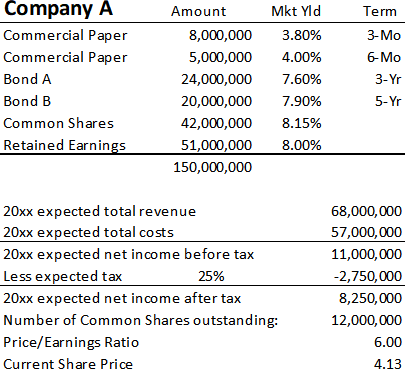

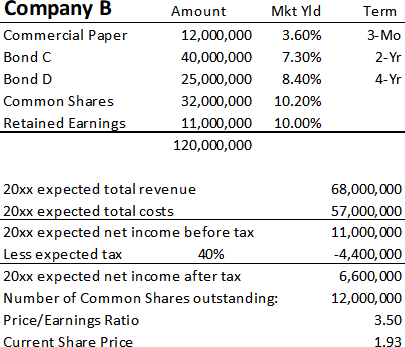

The company you work for (Company A) is considering an all-stock merger with another competing company in the Western Canadian Sedimentary Basin. All else equal, if the merger goes ahead, your company expects to take a ‘manufacturing’ approach to the reserves, that will increase revenue by 40%, increase costs by 20%, and assume the debt of Company B. Company A will issue 5,600,000 additional shares to pay for all the common shares and retained earnings of Company B.

Company A:

Company A has reasonable production, and significant oil and gas reserves, but they are scattered throughout the basin. Merging with Company B will enable economies of sale.

Company B:

Company B has sizeable production, oil and gas reserves adjacent to Company A, and a high level of debt. Company B does not have the reserves to replace current production, and it will be difficult for them to continue without a merger.

Questions:

1. What is weighted average cost of capital of both companies, what will it be if the companies merged, and if there is a significant change; what is causing it?

2. If revenue and costs deliver as expected, and Company A retains its price/earnings ratio of 6.0x; what will the Company A share price be 3 years from now. Would this have been a good deal, and why?

3. How much might this analyst make on the stock option purchase at $4.13 per share? Would it be worth staying with the company for another 3 years?

----- *** -----

What do you need to do?

1. Establish your needs.

o Calculate WACC for both companies.

o Calculate the Combined WACC, using Company A market yields where possible.

o Reconciliation of Coy A WACC, pre/post merger.

o Projection of Coy A net income after tax/share 3 years from now.

o Valuation of the company share option if this works out.

2. Collect the inputs.

o Not required, as the data is already given.

3. Design/build your model.

o Calculate what the component costs are, and their weights.

o Variance comparison of before and after WACC.

o Share valuation 3 years from now.

o Option profit 3 years from now.

----- *** -----

What does the grader need to see?

o WACC for Coy A, Coy B, and the combined company. Reconciliation of Coy A WACC pre and post acquisition, conclusion, comment on at least 1-2 differences.

o Projected Coy A net income after tax three years from now. Conclusion, and 2-3 reasons supporting it.

o Projected option valuation. Conclusion and a supporting value.