ECON 7280: Topics in Macroeconomics

Assignment 2

1 Multiple Choice

1) Consumption smoothing refers to

A) the tendency of all consumers to choose the same amount of current consumption.

B) the tendency of consumers to seek a consumption path over time that is smoother than income.

C) the tendency of consumers to seek an income path over time that is smoother than consumption.

D) consumer’s concerns about going heavily into debt.

2) Lifetime wealth is

A) the quantity of assets the consumer has in the current period.

B) current income plus future income.

C) current income minus discounted future taxes.

D) the present value of disposable income.

3) The consumer’s lifetime budget constraint states that

A) the present value of lifetime consumption must be equal to the present value of lifetime gross income.

B) the present value of lifetime consumption must be equal to the present value of lifetime disposable income.

C) the present value of lifetime consumption plus the present value of lifetime taxes to be paid must be equal to the present value of lifetime income.

D) the present value of lifetime taxes to be paid by the consumer must be equal to the present value of government spending.

4) The endowment point is the consumption bundle in which

A) households maximize utility.

B) households are indifferent to interest rate changes.

C) permanent income is maximized.

D) savings are zero.

5) A consumer is a borrower if

A) optimum current consumption is less than current disposable income.

B) optimum current consumption is greater than current disposable income.

C) future disposable income is greater than current disposable income.

D) the consumer’s indifference curves are relatively steep.

6) In the data, which of the following is most volatile?

A) real GDP

B) consumption of durables

C) consumption of nondurables

D) consumption of services

2 Essay Question

1) Suppose there are two countries. In the rich country, the representative consumer has Hr units of human capital, and total factor productivity is zr. In the poor country, the representative consumer has Hp units of human capital, and total factor productivity is zp. Assume that b and u are the same in both countries, Hr > Hp, and zr > zp.

(a) How do the levels of per capita income, the growth rates of per capita income, and real wages compare between the rich and poor countries?

(b) If consumers could choose their country of residence, where would they want to live?

2) We consider a semi-endogenous growth model shown in the class, but we set n = 0 and let the constant size of the labor force be L = 1

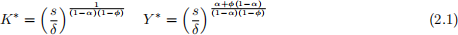

(a) Show that the stead state values K∗ and Y ∗ respectively are

What is the steady state value of At?

In the following let α = 3/1 and s = 0.24 everywhere. Let δ = 0.08 initially and after a shift, fall permanently down to δ = 0.06. Consider three different values for ϕ : 0.5, 0.75, 0.9.

(b) For each value of ϕ, compute the steady state values of Kt and Yt before and after the shift in δ.

3 Data Analysis

This part I want you to get familiar with the real data and the way to process data. You are encouraged to use Stata or R or Excel to do the following exercise. Answer these questions using the Federal Reserve Bank of St. Louiss FRED database, accessible at http://research.stlouisfed.org/fred2/

(i.) Plot the ratio of aggregate consumption (Personal Consumption Expenditures (PCE), monthly) to GDP(Gross Domestic Product, nominal, quarterly). Remember to convert PCE to quarterly frequency.

Comment on the features of your time series plot. What principle of consumption behavior helps to explain what you see?

(ii.) Plot the percentage change in the relative price of housing, along with the percentage change in real consumption of nondurables and services (Personal Consumption Expenditures: Nondurable Goods + Personal Consumption Expenditures: Services, all monthly).

Calculate the relative price of housing as the Case and Shiller 20-city home price index (monthly) divided by the consumer price index (Consumer Price Index for All Urban Consumers: All Items in U.S. City Average (CPIAUCSL), monthly).

What do you see in the plot? Does the value of housing appear to matter for consumption behavior?

If so, why should it? If not, why not?

Apart from your solution, you should also upload a Stata/R/Excel file to show how you get the result.