Hello, if you have any need, please feel free to consult us, this is my wechat: wx91due

ACC207 Econometrics in Accounting & Finance

ASSESSED PROJECT BRIEF: PART A

Spring semester 2024

The following instructions are for Sections A and B together. However, this document includes only Section Aquestions. The full project brief, including Section B, will be released to you later.

MUST-READ Instructions:

1. This coursework is the sole and final assessment for the module ACC207, and represents 100% of the final grade for the module.

2. This coursework contains two sections, A and B, with each section carrying 100 marks. Your final grade will be the average mark of the two sections. Thus, sections A and B carry equal weight. All parts of both sections must be completed.

3. The answers to all questions should be submitted in a single Word document with clear question numbering (i.e.,A.1,A.2…, B.1, B.2…). All R codes MUST be reported in your solution document. Short pieces of R code should be reported directly in your answer to each question. If your code is long, you may place the code in a numbered appendix at the end of the document, and clearly refer to the appendix number in the main text. The R codes should clearly indicate the question numbers to which they relate. Failure to report your R codes in the report or appendix will result in a low mark.

4. Deadline: Sunday 2nd June at 23:59 (to be submitted on LMO).

5. Submission: rename your file with your FULL name (in Pinyin/English letters:

given name followed by surname) and student ID. (e.g., San Zhang 123456)

Submit one Microsoft Word file using the relevant submission link on LMO.

6. In case of questions, contact one of the module staff well before the deadline:

Dr. Brian Wright ([email protected])

Dr. Sherry Luo ([email protected])

Mr. Lou Yang ([email protected])

7. All answers must be given in English.

8. It is your responsibility to retain a copy of your solution file, in case the submitted file is corrupted.

Section A: Simulation, Multiple Linear Regression and Hypothesis Testing (50%)

Question A1:

Suppose you are given a sample of 100 observations on two variables, X & Y. You want to estimate the relation:

yi = β0 + β1xi + εi (1)

Your main interest is in estimating the slope coefficient, β1 .

It has been suggested that, rather than estimating Eq. (1) on all 100 observations, it might be better to split the sample into two groups of 50 observations, and estimate Eq. (1) on each of these. If the groups are called Group A and Group B, then it is proposed that the estimator:

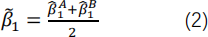

might be a ‘better’ estimator than  for β1.

for β1.

Required:

Which estimator will be better, the OLS estimator  , or the new

, or the new

estimator  ?

?

Make your choice by using simulation in R, based on the hypothesised relation:

yi = 180 + 40Xi + εi

where 0 ≤ X ≤ 80; εi ~N(0, 20000) (3)

Simulate 1,000 samples of 100 observations, and use these simulated samples (and any further necessary analysis) to determine which estimator is better.

In your solution, you should explain your logic, and include the R code that you used in generating results. You may also give graphical material, if you deem it helpful in answering the question.

Your simulation-based answer may also be supported by relevant algebraic analysis, if you wish (but should not be replaced by algebraic analysis).

(Total 50 marks for Question A1)

Question A2:

You have been provided with a dataset in the Excel file QuestionA2.xlsx. The dataset contains observations on three variables relating to a sample of listed companies for the year 2023: MktValue,

BkValue, and RI.

The definitions of the variables are as follows:

MktValue = the market value of the company (debt plus equity);

BkValue = the book value of the company (shareholders’ equity

accounts plus book value of debt);

RI = the residual income of the company for the year.

All MktValue and BkValue values are year -end values for the year 2024; all RI values relate to the 12 -month period for the relevant company, ending on 31st December 2023. You may assume that all companies have the same accounting year-end date.

You are interested in studying the relationship among the three variables. It has been suggested that the following relationship may hold, on average, among the variables:

Mktvalue = Bkvalue + Pv(Future Residual Income)

It has also been suggested that current residual income might be a

good indicator of future residual income for a company, so that:

Pv(Future Residual Income) = YRI

for some constant Y.

You are thus interested in estimating the following regression

equation, using OLS regression:

Mktvaluei = β0 + β1 Bkvaluei + β2 RIi + εi

where:

i= index representing the firm;

εi = stochastic error term, assumed normally distributed with zero expected value.

Theory suggests that the coefficient on BkValue, β1 , should have a value of unity (i.e., +1). Your colleague Bob, an investment analyst, thinks that a likely capitalisation rate for residual income is 5 (i.e., she thinks that β2 = 5.

Required:

(a) Estimate, using OLS, the regression:

Mktvaluei = β0 + β1 Bkvaluei + β2 RIi + εi

Give a full interpretation of the regression results, which you should obtain from R. Show clearly, in the text of your report, the R code you used to perform the estimation. Perform all relevant regression diagnostics. If you think there are any potential problems with the model, based on your regression diagnostics, then discuss these here. (You can ignore heteroskedasticity and autocorrelation in this part of

the question; these will be dealt with in part (d) below).

Now, for parts (b) and (c), assume that the regression in part (a) is valid and well-specified.

(20 marks)

(b)Test the restriction that β1 = 1. Separately test the restriction that β2 = 5.

(10 marks)

(c) Test the joint hypothesis that β1 = 1 and β2 = 5.

(10 marks)

(d) Are there any issues with autocorrelation or

heteroskedasticity in this model? If not, discuss how you know this. If so, how can the problem(s) be fixed?

(10 marks)

(Total 50 marks for Question A2)